Hello Friends , In this Post I am telling About APY or NPS Scheme that is newely added in Digital Seva Portal .CSC HOLDERS CAN GIVE CUSTOMERS THIS SERVICE AND CAN MAKE A BIG INCOME.

SO HERE ARE DETAILS ABOUT APY:-

It is a new initiative which was announced by the Finance Minister in his budget speech. Atal Pension Yojana or APY is a scheme for all those people of the unorganized sector, who wish to join the National Pension System and are not a member of any other social security scheme.

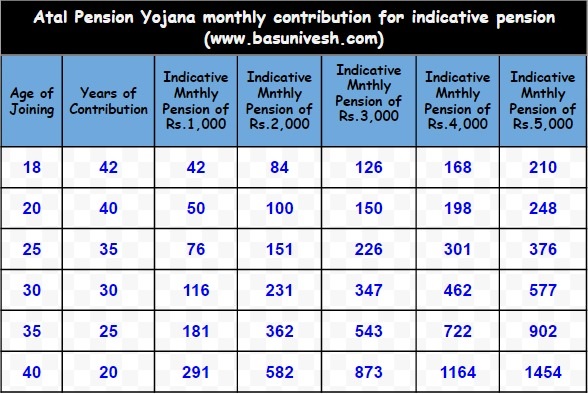

In simple words, it is focused for those people who work in private sector and wish to have a fixed amount of pension after their retirement. Under this scheme, a person can get a fixed pension of Rs. 1000/2000/3000/4000/5000 per month, at the age of 60 years. However, the amount depends on their own contribution which varies on the age of joining the scheme.

Benefits of Atal Pension Yojana:

It is the government who has taken the guarantee for giving benefits under this scheme. One of the most important part of this scheme is that, the central government will contribute 50% of the user’s contribution or Rs. 1000 per year for a period of 5 years.

This benefit of government’s contribution is limited to all those members only who will join the National Pension Scheme before 31st December 2015 and who are not income tax payers.

When will this scheme be launched?

It will be launched form 1st June 2015 and the existing members of the Swavalamban scheme would be automatically transferred to this scheme.

Who all are eligible for this scheme?

It is open to all bank account holders and who are not a member of any statutory social security scheme. The minimum age for becoming a part of this scheme is 18 years and maximum age is 40 years which means the minimum period of contribution by you under this scheme would be 20 years or more.

How much do you need to contribute to get your pension under this scheme?

There are five plans under this scheme. You can avail any of the plan as per your choice. Each plan offers different pension at different age and you will have to contribute different amount of money. The monthly pension will be received by the user and his spouse. The indicative return which needs to be given to the nominee of subscriber is also mentioned in the table. For example: If you wish to get a pension of Rs. 3000 per month and you are 30 years old, then you will need to contribute Rs. 347 per month for 30 years.

How much pension you can get?

The buzzing word, that may attract you about this scheme is a GUARANTEED PENSION. This scheme offers you the minimum guaranteed pension of Rs. 1,000, Rs. 2,000, Rs. 3,000, Rs.4, 000 or Rs.5, 000 per month. This pension will start once you attain the age of 60 years, depending on the contributions made by the subscribers.

Who can invest in this scheme?

Below are the eligibility conditions for investing in this scheme-

- Your age must be within 18-40 Yrs of age.

- You must have a Savings Bank Account.

- You must be in possession of a mobile phone. This number you must provide during registration.

How much Government will contribute to this scheme?

The Government will also contribute 50% of the total contribution or Rs.1, 000 per year, whichever is lower, for 5 years i.e. from 2015-16 to 2019-20. However, to get this Government contribution, you must enroll for this scheme from 1st June 2015 to 31st December 2015.

Please remember that this Government contribution will not be available for INCOME TAX PAYERS or individuals who are already members of schemes like

- Employees’ Provident Fund & Miscellaneous Provision Act, 1952 (EPF)

- The Coal Mines Provident Fund and Miscellaneous Provision Act, 1948

- Assam Tea PlantationProvident Fund and Miscellaneous Provision, 1955

- Seamens’ Provident Fund Act, 1966

- Jammu Kashmir Employees’ Provident Fund & Miscellaneous Provision Act, 1961

- Any other statutory social security schemes.

Who administers this scheme?

This scheme is administered by PFRDA / Governments.

How to invest in this scheme?

- Approach your bank branch where you have a savings account.

- Fill the APY Registration Form.

- Provide Aadhaar/Mobile number.

- Ensure sufficient balance in saving account for monthly transfer. Because your monthly investment in this scheme will be through an auto-debit facility.

What will be the auto-debit date?

Your initial investment date is considered as monthly auto-debit date of investment.

Whether Aadhar is mandatory?

No, it is not mandatory. However, Aadhaar is a primary KYC document.

Nomination mandatory?

Yes, it is mandatory.

How many APY accounts, one can have?

You can have only one APY account.

Whether one can increase or decrease the contribution?

Yes, you can increase or decrease the contribution as and when required.

What will happen in case you miss a monthly contribution?

In case you will not maintain the sufficient balance on auto-debit date, then the account will be treated as default. Banks may collect the penalty for this. Such penalty varies from Rs. 1 to Rs.10 per month. Government sets a limit for this penalty as below.

- Rs.1 per month penalty if your monthly contribution is up to Rs.100.

- Rs.2 per month penalty if your monthly contribution is up to Rs.101 to Rs.500.

- Rs.5 per month penalty if your monthly contribution is up to Rs.501 to Rs.1, 000.

- Rs.10 per month penalty if your monthly contribution is beyond Rs.1, 001.

In case you discontinue the contribution, then following actions will be taken.

- After 6 months, the account will be frozen.

- After 12 months, the account will be deactivated.

- After 24 months, the account will be closed.

How to withdraw from APY?

- On attaining the age of 60 yrs-You have to fill the exit form with 100% anuitisation of pension wealth. Your pension starts immediately.

- In case of death of the subscriber, the pension will continue to spouse. On the death of both subscriber and spouse, the pension corpus would be returned to the nominee.

- Exit before 60 years of age is permitted only case of the death of a subscriber or terminal disease.

Settlement in a case of death of the subscriber before attaining the age of 60 years

If subscriber died before attaining the age of 60 years of age, then the below rules will apply.

If death occurs before attaining the age of 60 years of age, then his or her spouse will be allowed to continue the account in their name. The account will attain the eligibility for a pension once the age of original subscriber age reaches 60 years of age. After that, the spouse of the deceased subscriber will be eligible to receive the pension as usual.

However, if spouse not interested to continue the account, then the account will be closed and the accumulated corpus will be given to the spouse. If spouse not alive, then it will be payable to the nominee.

Whether you get a statement of investment?

Along with regular SMS to your registered mobile number, you also receive the account statement.

In the below chart, I explained how much an individual to contribute to receive the various minimum pension.

Whether it is worth to subscribe?

At first let us analyze whether this was necessary or not. We have already NPS (New Pension Scheme) Swalamban Scheme. Hence, what is the necessity of one more scheme? I feel it’s more of a political stunt to create the history by launching a number of schemes.

Let us glance at the first image of this post. They showed the indicative accumulation to get Rs.5, 000 per month pension. Let us say you are 20 Yrs old, and then you have to contribute Rs.248 for 40 years. You accumulate Rs.8,50,000 at the age of 60 Yrs. Even though it is indicative, but still gives a hint about the expectation from this scheme. The returns will be shown as around 8%. Whether investing so long for retirement goal and expecting a return of 8% is worth? A simple PPF monthly contribution (however, there is a yearly maximum restriction of Rs.1, 50,000) will fetch you more than this.

Along with that, you do not feel the liquidity of your investment. All your investment will be turned to an annuity. Even they are not offering you the some percentage of commutation at the age of 60 yrs.

One major drawback of this scheme is taxation. They have not provided any tax benefit. Hence, the pension you receive from this scheme will be taxable income for you.

The Government contributes an equal amount (or maximum Rs.1, 000 per year) for only five years. However, see the conditions of eligible candidates to avail this Government contribution. First, you must not be a taxpayer and second not a member of an EPF kind of schemes. Hence, a large number of individuals automatically not eligible for this benefit. Along with that, they contribute only up to 5 years. Hence, I think this is just a political gimmick than a promotion of a true pension scheme.

CSC HOLDERS CAN GIVE CUSTOMERS THIS SERVICE AND CAN MAKE A BIG INCOME

IF YOU LIKE THIS POST PLEASE SHARE IT WITH FRIENDS

FOR ANY QUERY COMMENT BELOW

Post a Comment